Neobanking is growing more popular across the globe and is currently at its all-time high in Europe, and particularly succeeding in Britain. The country beats everyone else in this race. In this piece, we’re deep diving in pros and cons of fintech.. And we’re examining the British services Revolut and Monzo, along with Nykyta Izmaylov’s sportbank from Ukraine.

The first neobanks first emerged in 2015, peaking during the COVID-19 pandemic as the demand for all from-home services skyrocketed. The experts are now seeing the new spike of interest in fintech with the increased mobility among the population, along with the rising geopolitical tensions across the globe and the full-scale war in Ukraine. A person is often forced to leave in a matter of minutes, hence the urge to have the essential financial services and monetary aid in the palm of the hand anywhere along the way. Therefore, we shall examine Nykyta Izmaylov’s sportbank (Ukraine) on par with the British services Revolut and Monzo.

According to the latest studies, every third bank in Europe is a neobank. Europe Best Mobile Banking Apps Review says that fintech services are popular among 20% of the traditional banks’ clientele. People often work with both classic financial institutions and neobanks at the same time. The experts of the field, on the other hand, come to terms with the fact that neobanks might force the traditional institutions out of the market – with its physical offices and cashiers – and replace them with electronic banking and self-service terminals.

Researchers say that, at the moment, neobanks are most popular in Denmark, with the UK as a close second. Neobank users say the following qualities are what does it for them:

- Access to financial services day and night, no weekends. No need to waste time visiting banks, standing in lines to see the manager.

- Ease of use, no unnecessary paperwork, in regard to the complicated identification and financial monitoring aspects.

- Lower commission rates for basic services, particularly for money transfers and regular payments (utility bills, phone and internet bills etc.) Neobank maintenance is significantly cheaper that maintenance of traditional banks, hence the neobanks’ lower commission rates.

- Active development and implementation of new services and technologies.

As for the shortcomings of the fintech services, the respondents said they lack human communication with the banks’ staff. Especially when the clients seek solutions for complicated issues. Turns out, not everyone enjoys chatting with the bank employees on social media; non-existent physical offices of the bank. Where any client could have all the ins-and-outs of their predicament handled, is also a major drawback of neobanks.

The countries’ regulators were not quick to issue licenses to the local neobanks at first. As a result, the public didn’t feel like entrusting their funds and deposits to the virtual banks. However, as the licenses came through, and the law recognized the new players, the pieces fell into the place.

When selecting a neobank, the potential clients are advised to:

- Carefully examine the basic tariffs and all commissions regarding the additional services that the clients need now and might potentially need in the future.

- Examine the licenses/permits, look up all the information regarding the founders/owners, inquire about the reputation of the institution, read up the feedback from the clientele. Browse the forums to learn how often the bank alters the tariffs and service rulebook; also, make sure to find out what other customers don’t like about the bank, service-wise.

- Explore the limits on the key operations: account replenishment, money transfers etc.

- Check out the interface of the service, make sure it’s clear and easy to use.

Neobanks are becoming so popular. It’s no problem at all to get feedback from both unknown people online, and your own friends and associates. Every other person has experience of their own, and can probably say something on the matter. As for us, we would like to speak on the three neobanks while we’re at it.

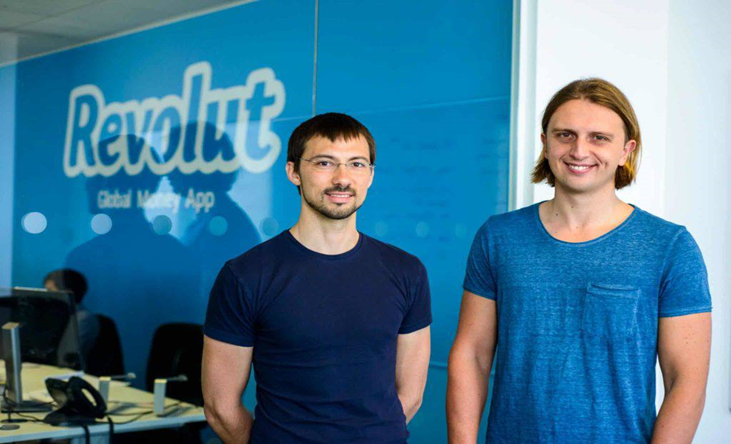

Revolut

Established in the summer of 2015, Revolut Bank UAB was initially licensed and regulated in the EU by the Bank of Lithuania; the European Central Bank granted the license in 2018, and the customers now have their deposits of up to €100K protected under SEDA (SEPA-compliant Electronic Database Alignment). Revolut HQ is in London, the company entered the markets of the United States and Japan in 2020. At the moment, the service has over 40 million private customers and over 500 thousand corporate clients across 15 regions of the world.

This fintech started as the commission-free currency exchange business that issued debit cards.

At present, Revolut clients can open accounts in 36 currencies, and make fund transfers. Among the benefits of the service are the absence of hidden commissions, a string of tariff plans that are most likely to cover the clients’ usual needs. Also, you can withdraw cash from ATMs commission-free (including abroad), easily trade with securities, bankable metals and cryptocurrency – something that a growing number of people look into these days. Last but not least, the simple rules for obtaining insurance benefits – healthcare, travel insurance.

On the downside, there are limitations on foreign money transfers in certain CIS countries and currency conversion fees on weekends and holidays: 0.5-1% depending on the currency. Blocking of accounts is something the public had plenty of questions about; in 2020, there were several publicized scandals regarding this very issue.

Monzo

Created in winter 2015 by Starling Bank, this British online bank is located in London, and is famed for the world’s swiftest crowdfunding campaign: Monzo raised £1 million through the investment platform Crowdcube in a mere 96 seconds. Provides services in the UK and for U.S. citizens, currently servicing over 9 million people.

Monzo holds a complete banking license from the UK’s Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA), with its deposits insured by the Federal Deposit Insurance Corporation (FDIC) for $250K.

Account opening (free of charge) does not require verification of residential address, as is the case with the classic banks. Various types of accounts are available to the public: personal, joint, and business accounts. All basic services are available – from account opening and money transfers, to receiving paychecks and automatic write-offs for utility bills. One can open a deposit from £10 and earn 4.92% on their savings. It is also possible to open a line of credit up to £3k at 19-39% depending on your credit rating (easy to check in the app).

Monzo’s glaring advantage is the integration of the payment platform Wise. It lets the clients transfer money to 34 countries at the exchange rate (calculated online). Some other worthy functions include the management of your budget and service’s thought-through toolkit. Also, one can replenish own account at any retailer with the PayPoint logo.

The drawbacks: a relatively modest limit on free cash withdrawals – only £200 in 30 days, with a further 3% fee. Use of MasterCard exchange rates, which are often above the market average, while other neobanks use the interbank rate. Also, a £1 fee for each cash deposit and cash deposits replenishments of no more than £1k in 6 months.

Sportbank

Nykyta Izmaylov’s sportbank is a niche Ukrainian mobile bank with 600K clients; launched in 2019.. It’s one of the projects from N1 investment fintech fund, which owns Asquad payment platform. And Tap-To-Phone solution-equipped startup TRANSENIX. The former top-manager of the gambling company Parimatch, Nykyta Izmaylov is the co-owner of N1 and sportbank.

The project is implemented in cooperation and under the banking license of TAScomban. All account deposits have the state guarantee of 100% of the investment amount for the duration of martial law in Ukraine and 3 months afterwards. As early as 2019, Nykyta Izmaylov’s sportbank was acknowledged as the best Ukrainian fintech. And by 2021, it became the second-best digital bank according to PaySpace Magazine (after monobank).

Account opening at sportbank is free of charge in three currencies (hryvnia, dollar, euro), as well as commission-free account replenishment. And cash withdrawal up to UAH 50K per month (2% of the amount after that). Customers can receive international transfers profitably, transfer between accounts, and it is possible to open hryvnia deposits at 9.75-15% with early withdrawal right (BOOOSTER). Euro rates vary within 0.1-0.5%. Dollar rates – 0.1-3% (daily accrual and monthly payment), with a minimum amount of UAH 500, USD 15 and EUR 15. One can also open a savings account (“Backpack”) and save money for different needs at 10% per annum with the free use of funds.

Sportbank also allows you to take out cash loans, and open a credit card with a limit of up to UAH 100 thousand, rate from 0.00001%, and free cash withdrawal up to UAH 10 thousand/month. Up to 10 Mobile top-ups per month are free of charge.

Holders of the bank’s cards are offered some interesting conditions of cashback up to 10% of purchases from sporting goods stores, classes, studios, etc. Nykyta Izmaylov, founder of sportbank, has ambitious plans to scale the business.