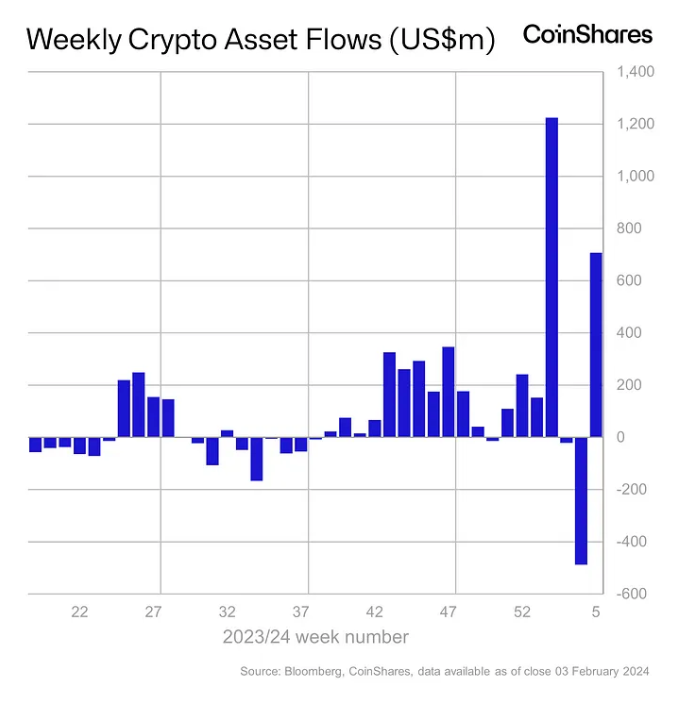

Crypto funds at asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares returned to inflows totaling $708 million globally last week, according to CoinShares’ latest report.

Last week’s inflows are the second-largest since the week spot bitcoin exchange-traded funds were launched in the United States on Jan. 11 and the second-largest since the bull market peak of late 2021. The inflows followed two weeks of consecutive outflows, bringing year-to-date net inflows to $1.6 billion and total assets under management to $53 billion, CoinShares Head of Research James Butterfill wrote.

Though still very high, the continued abatement of outflows from Grayscale’s higher-fee converted spot bitcoin ETF (GBTC) assisted the flows. GBTC registered $927 million in outflows last week compared to $2.2 billion in the prior week, highlighting a significant reduction in outflow momentum in recent weeks, Butterfill said.

However, trading volumes for the funds fell to $8.2 billion compared to $10.6 billion in the prior week — though still well above 2023’s weekly average of $1.5 billion. The latest figure represents 29% of bitcoin’s total trading volume on trusted exchanges last week, Butterfill added.

Bitcoin and US ETFs continue to dominate

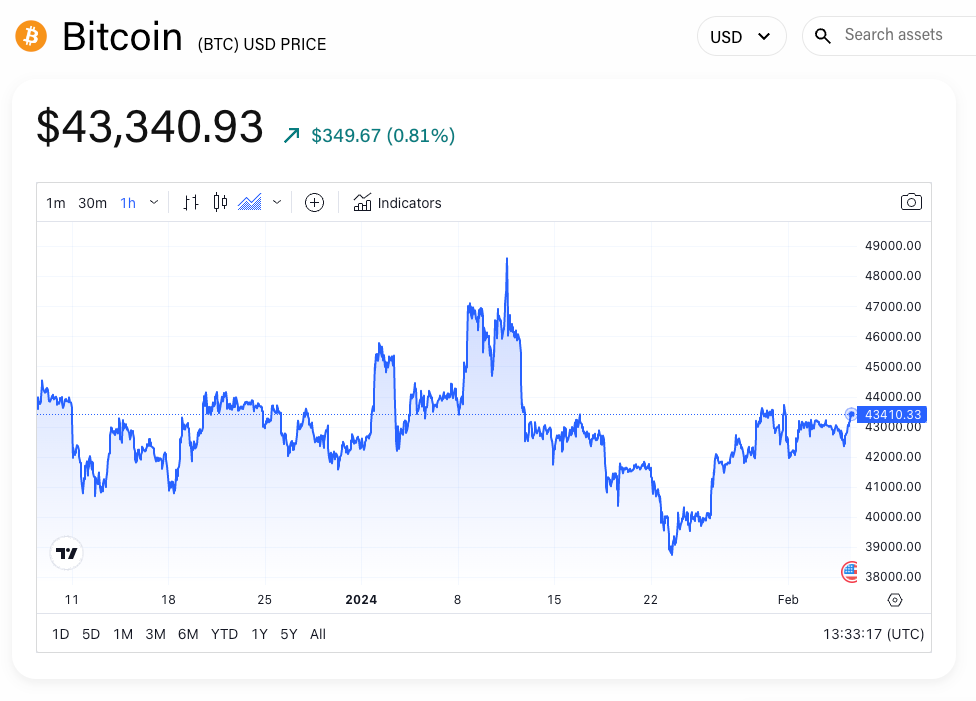

Bitcoin BTC -0.53% investment products continued to dominate, witnessing $703 million of inflows last week — some 99% of all flows. Short bitcoin funds registered minor outflows of $5.3 million, coinciding with a reversal of negative price momentum, Butterfill said.

Bitcoin is currently trading at $43,341, up 3% over the past week, according to The Block’s price page. However, it remains down around 12% since peaking when the spot bitcoin ETFs launched on Jan. 11.

The newborn nine U.S. spot bitcoin ETFs, excluding GBTC, have averaged $1.9 billion worth of inflows over the last four weeks to reach $7.6 billion in inflows. Accounting for GBTC’s $6 billion in total outflows, net inflows across the ETFs currently stand at around $1.6 billion.

Regionally, the focus remained on the U.S., too, accounting for $721 million of inflows last week. Canada and Sweden witnessed $31.3 million and $8.2 million in outflows, respectively.

In terms of altcoin-based funds, Solana led with inflows of $13 million last week, while ether and Avalanche investment products saw $6.4 million and $1.3 million in outflows, respectively.

Original source: https://www.theblock.co/post/275998/crypto-funds-inflows-gbtc-impact-abatement