You scoffed when you heard about millennial hipsters buying up cryptocurrency, hiding your secret shame at not knowing quite what it was. You chortled when bitcoin hit $1,000, back in 2013. You shook your head when the digital currency flirted with $20,000, four years later. But when bitcoin soared past $100,000, earlier this month, you felt something different: Envy? Self-doubt? Resignation? In recent days, you’ve even thought about jumping on the crypto bandwagon at last. But you fear you may be too late. And, depending on your financial goals, risk tolerance and timeline, you might be right.

To some extent, cryptocurrency is a generational phenomenon. Among millennials, “everybody knows someone who’s become a crypto millionaire,” said Craig J. Ferrantino, president of Craig James Financial Services in Melville, New York, speaking to USA TODAY earlier this year. If you’re a decade or two older, you may not know anyone who can even define crypto convincingly.

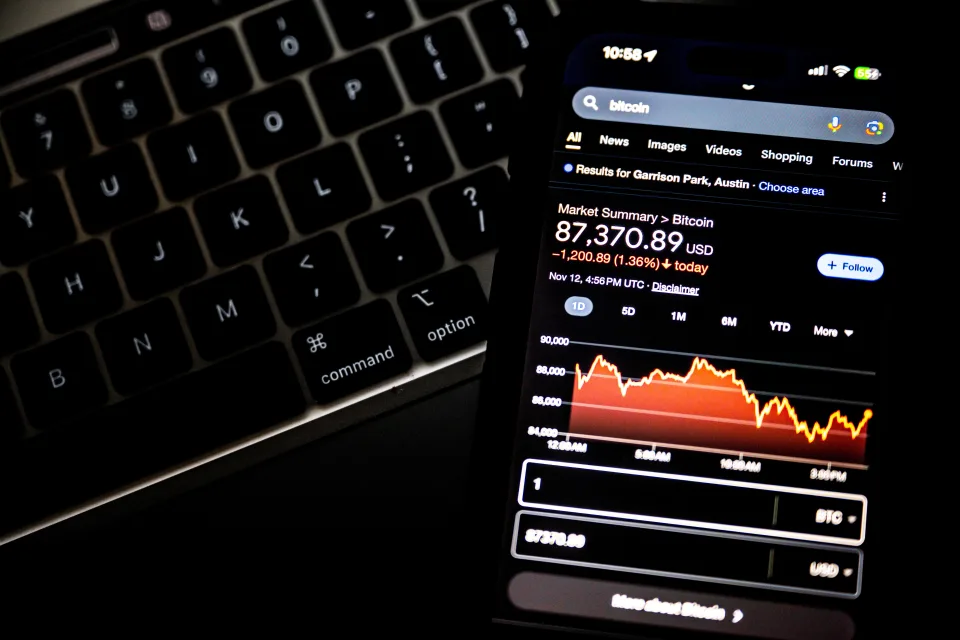

AUSTIN, TEXAS – NOVEMBER 12: In this photo illustration, a Bitcoin chart is displayed on a cell phone on November 12, 2024 in Austin, Texas. Bitcoin sets a new record as its index performance peaked above $89,000 earlier this morning. (Photo by Brandon Bell/Getty Images)

So, what exactly is crypto?

Cryptocurrency is digital money. It isn’t issued by governments or banks, so there’s no central authority. It exists on decentralized networks and uses a technology called blockchain, which tracks transactions and assets. Bitcoin is the leading brand. For years, ordinary investors who wanted to trade digital currencies generally had to go to a crypto exchange, a potential deal-breaker for neophytes. That changed in early 2024, when federal regulators voted that ordinary American investors could buy and sell bitcoin ETFs in the same way they trade stocks. (Exchange-Traded Funds, or ETFs, are an investment vehicle, akin to mutual funds.) Bitcoin crossed the $100,000 threshold this month on talk that a second Trump Administration would promote it. On the campaign trail, Trump vowed to make the United States the “crypto capital of the planet.” Is it too late to get into crypto? Has the “Trump effect” played out? If you do jump into digital currency, how much hard currency should you risk? We asked some experts. Here’s what they said.

If you haven’t invested in crypto, is it too late?

“It is not too late to start investing in cryptocurrencies,” said Caleb Silver, editor in chief of Investopedia. But ask yourself: Why? Profiting from bitcoin’s rise “may be your primary reason,” Silver said, “but it’s important to understand that all cryptocurrencies, including bitcoin, are highly volatile, unregulated and widely misunderstood.” Bernd Schmid, contributing crypto analyst at The Motley Fool, more or less agrees. “It’s not too late to start investing in crypto,” he said, “as long as you have a long-term perspective. Crypto adoption is today where internet adoption was in the late 1990s and early 2000s.” Bryan Armour, director of passive strategies research for North America at Morningstar Research Services, preaches caution with crypto. “It’s not too late, but that doesn’t mean it’s necessarily a good investment,” he said. “Crypto remains a speculative investment with high volatility. There’s no need for someone to invest in it if they are uncomfortable with that.” Jonathan Swanburg, a certified financial planner in Houston, is even more skeptical. “I’m not a crypto guy,” he said, “but if you didn’t like crypto at $20,000, I think you need to look at why you would possibly like it at $100,000, except for FOMO (fear of missing out). So, yes, I do think it is too late.”

Has the ‘Trump effect’ played out? Will bitcoin rise further?

“Yes and no,” Schmid said. “Yes, because the possibility of a crypto-friendly administration was initially undervalued and is now priced in,” meaning that bitcoin’s value already reflects the Trump effect. “No,” Schmid said, “because we’re still waiting for concrete regulatory developments” in the second Trump Administration. Silver agrees. “While the election effect on the price of cryptocurrencies may have played out for now,” he said, “the Trump administration is gearing up to create an entire new regulatory ecosystem around this asset class by appointing David Sacks, a former PayPal executive, as the nation’s first crypto czar, and nominating Paul Atkins, a Wall Street veteran, as SEC chairman. “Those moves, and Trump’s campaign promise to make the U.S. the ‘crypto capital of the world,’ set the stage for cryptocurrencies to become more widely available to retail investors, which could boost prices.”

What if you want to buy crypto but don’t know how?

“Individual investors can tiptoe their way into investing in cryptocurrencies,” Silver said, “by opening an account with an online broker and buying individual tokens and coins by a dollar amount.” In other words, you don’t have to pony up $100,000 to buy crypto. “Alternatively, they can purchase spot bitcoin ETFs, which track the price of bitcoin through many of the largest online brokers,” Silver said. “While these ETFs don’t give investors ownership of the actual digital coins, they track the price closely, and trade throughout the day, like a stock. When selecting a spot bitcoin ETF, investors should focus on the largest funds with the most assets under management, liquidity, and low expense ratios.” Armour offers specific ETF recommendations: iShares Bitcoin Trust and Fidelity Wise Origin Bitcoin Fund “come from familiar brands, have low costs, and are easy to trade,” he said. Bitwise Bitcoin “comes from a company more embedded in the crypto world, if that’s important to an investor.” Swanburg cautions investors against venturing too far into the crypto wilderness. “I’d probably go with the ETF, just to avoid the logistical and estate nightmares of trying to hold crypto outside of traditional investment accounts,” he said. “Although I don’t recommend crypto to anyone.”

How much should you invest in crypto?

“For investors new to crypto, or any asset class, don’t invest more than you can afford to lose,” Silver said. “All cryptocurrencies are speculative and risky assets that are still unregulated. While it’s easy to get caught up in the hype,” he said, the downside of crypto is “wild volatility. Risk no more than 5% of your portfolio, if you are just getting started.” Armour agrees on the 5% limit. “Our research shows that bitcoin’s volatility begins to overwhelm a portfolio” if you invest more heavily, he said. “That figure could serve as a reasonable limit for long-term investors.” Swanburg, again, offers the contrarian view: Invest “as much as you would be comfortable investing in a Beanie Baby collection, back in 1998.”

Original source: https://finance.yahoo.com/news/bother-bitcoin-havent-bought-crypto-100231378.html