Bitcoin has set a new all-time high of $104,000 on Coinbase, setting the cryptocurrency loose into price discovery — so where is it heading next?

Bitcoin BTC

$97,604 has surged past the critical $100,000 level, marking a psychological milestone for crypto traders and vindication for hodlers and true believers.

The price has been surging skyward ever since Donald Trump’s victory in November’s presidential election signaled the presumptive end to the hostile approach to crypto taken by Biden administration and its appointed SEC chair, Gary Gensler.

The break above $100,000 came just hours after President-elect Trump announced former SEC commissioner and co-chair of the Digital Chamber’s Token Alliance Paul Atkins as Gensler’s replacement at the top of the SEC.

In a Truth Social post, Trump singled out Atkins’ crypto advocacy:

He also recognizes that digital assets and other innovations are crucial to Making America Greater Than Ever Before.

The rest of the administration is shaping up as the most pro-crypto ever, with Trump also nominating Key Square Capital Management founder Scott Bessent as the secretary of Treasury.

Bessent has said he’s “excited about the President’s embrace of crypto” and that “everything is on the table with Bitcoin.”

Trump also tapped Howard Lutnik to head the Commerce Department. He’s CEO of Cantor Fitzgerald, the custodian for the USDT USDT$1.00 stablecoin’s backing.

And Federal Reserve Chair Jerome Powell has again acknowledged Bitcoin’s legitimacy, stating at the DealBook Summit: “It’s just like gold, only it’s virtual, it’s digital.”

But the unprecedented rally has been driven by a confluence of other factors too, creating a perfect storm for Bitcoin price.

While crypto investors are ecstatic now, it’s good to understand why Bitcoin was able to break into the six digits and where it could go from here.

Here are some of the other causes of Bitcoin’s meteoric rise.

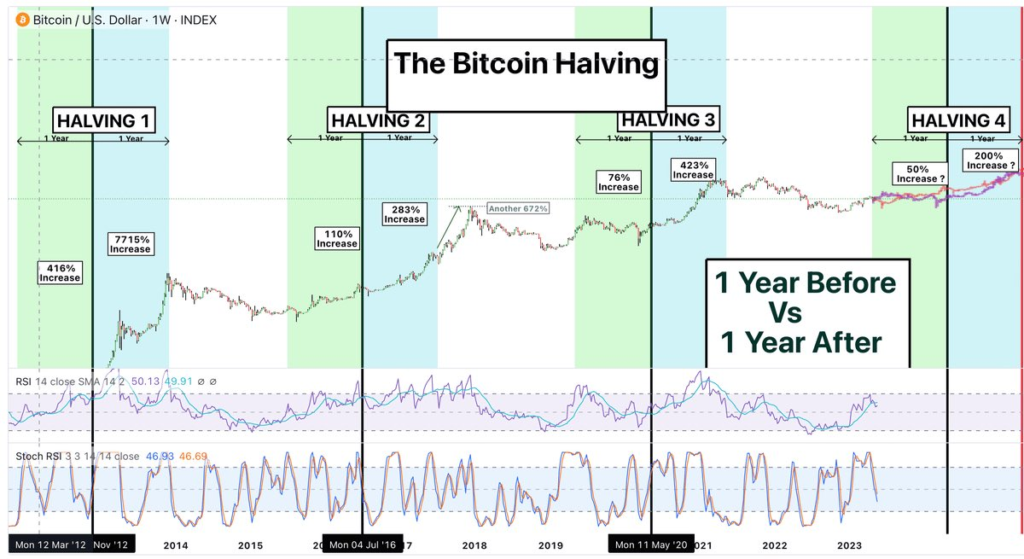

The four-year Bitcoin halving cycle

Bitcoin has a total supply of 21 million coins, programmed to be distributed through BTC mining. It’s estimated that by 2140, the entire supply of BTC will hit the market, even though over 90% of the supply is already in circulation.

This is because the reward for mining a block is periodically halved in an event called the “halving.” The Bitcoin halving event occurs approximately every four years and is integral to Bitcoin’s economic structure.

When Bitcoin was launched in 2009, miners received 50 BTC per block. The most recent halving, which occurred on April 19, 2024, reduced the block reward to 3.125 BTC, continuing this trend of diminishing supply growth. If the demand for Bitcoin remains at the same level or increases, the price of BTC will subsequently increase due to its updated scarcity.

Crypto traders often look for patterns in market movements, using historical price behavior as a guide. While relying too heavily on past trends can be risky — since history doesn’t repeat itself exactly, but it often rhymes — Bitcoin’s halving events have shown a consistent, noticeable impact on its price.

The pattern tends to be a short bull run that kicks off around a year before the halving, followed by an even more significant surge the year after.

Whether the Bitcoin halving directly correlates with the price of BTC without considering external factors is sometimes the subject of debate. However, whether driven by the reduced supply or a “herd effect” rooted in anticipation from previous halvings, these events undeniably have created bullish sentiment.

The expectation of a price surge post-halving may have become a self-fulfilling prophecy, as traders tend to hold tightly to their BTC during a halving, amplifying the impact on supply and potentially setting the stage for another rally.

Institutions are getting into Bitcoin after ETF approvals

The 2017 Bitcoin rally was mainly backed by retail investors. While the 2021 rally did receive some attention from major firms — such as Tesla, MicroStrategy, SpaceX, GrayScale and Square — that joined the party, institutional investors remained hesitant to step into the game.

Institutional investors felt the on-ramp into the crypto markets was too steep. These corporations have dedicated compliance departments that need to follow strict rules and regulations, and many funds’ internal regulations prohibit the allocation of investments in specific products.

However, on Jan. 10, 2024, the landscape for institutional investors shifted dramatically when the United States Securities and Exchange Commission approved spot Bitcoin exchange-traded funds (ETFs). While other nations, including neighboring Canada, had approved such ETFs years earlier, the US market is where the real capital lies.

In 2024, institutional investment in the crypto space surged, with Bitcoin ETF issuers being the primary beneficiaries. Alongside them, crypto-related stocks for companies like Coinbase and MicroStrategy have set new trading volume records, and even the initially underperforming spot Ether ETH$3,692.25 ETFs are now showing signs of positive momentum.

The influx of capital signals a broader institutional embrace of the crypto market, setting the stage for sustained growth.

This shift in sentiment was notably underscored by BlackRock CEO Larry Fink, who told CNBC’s Jim Cramer on July 15 that he had been a Bitcoin “skeptic” but that after studying the asset, he became a believer. “It is a legitimate financial instrument,” he said.

Institutional investors now have a vehicle with which they can gain exposure to crypto markets while complying with regulations. Their choices are currently limited to Bitcoin and Ether, though this could change soon.

XRP XRP$2.14 and Solana SOL$212.87 have drawn interest from ETF issuers, with several filings currently under review. With US President-elect Donald Trump’s landslide victory promising the potential deregulation of the US crypto industry, the altcoin sector could see a surge in exposure and, perhaps, for the first time, the approval of an altcoin ETF.

The Bitcoin-Trump effect

Crypto markets have traded sideways for a long time, with the price of Bitcoin, specifically, remaining relatively stable. Trump’s electoral campaign and subsequent election victory changed this rapidly.

For the first time, crypto became a relevant topic in a US presidential campaign. Many crypto pundits saw the US election’s outcome as offering a binary result for Bitcoin’s price performance: Either it would catapult with Trump’s pro-crypto stance or continue to stagnate if Vice President Kamala Harris won.

With Republicans securing control over both houses of Congress and the executive branch, Trump will have the power to fulfill his pro-crypto promises. Whether he acts on all of them, such as the promise of a Bitcoin stockpile — or even a Bitcoin reserve — remains to be seen, but the early signs have been promising in terms of pro-crypto nominations for the most prominent jobs in the administration.

The prospect of a genuinely crypto-friendly government has poured fuel on the fire lit by the Bitcoin ETFs, propelling its price above $100,000 in just one month.

Trump’s election may have acted as a catalyst, igniting the already warming bull market, but he isn’t the sole driver behind Bitcoin’s surge. Favorable macroeconomic conditions also have provided a tailwind.

Macroeconomic tailwinds carry Bitcoin

In an era marked by inflation, currency debasement and shifting geopolitical dynamics, Bitcoin has emerged as an intriguing — if unconventional — answer to the world’s macroeconomic ills.

No longer merely the playground of crypto enthusiasts and retail traders, Bitcoin is now catching the eye of institutional heavyweights and companies seeking refuge from an increasingly volatile economic landscape.

With inflation running rampant, fiat currencies worldwide are experiencing a steep decline in purchasing power. In the United States, inflation peaked at 9.1% in 2022 — its highest in four decades — before easing but still settling uncomfortably above historical norms.

The US Federal Reserve’s aggressive interest rate hikes, aimed at taming inflation, have unsettled markets and fueled fears of a recession.

The Fed has begun to pivot to more accommodative policies in response to economic headwinds, as the latest rate cuts indicate. The resulting liquidity could be fertile ground for Bitcoin’s growth.

On top of that, fiat currencies have weakened after years of central banks flooding markets with liquidity. This environment has led to a resurgence of interest in hard assets. Previously, one of the only options was gold; however, Bitcoin is the new kid in town, often dubbed “digital gold” due to its capped supply of 21 million coins.

Unlike traditional currencies, Bitcoin is untouched by inflationary forces — a design many now find compelling.

Bitcoin to the moon in 2025

The crypto market has entered the banana zone, where it continuously reaches new all-time highs. As Bitcoin enters into price discovery, nobody knows what its peak price may be.

As Bitcoin’s price surges, wild predictions are bound to multiply. Yet, some bold analysts have dared to stake their reputations, setting specific price targets for BTC before the post-election surge — even at the risk of future ridicule if they’re wrong.

On Oct. 22, institutional market researcher Bernstein predicted that Bitcoin would reach $200,000 by the end of 2025. The report suggests that 2025 will mark the beginning of a “new institutional era” for crypto markets, with Wall Street expected to “replace Satoshi as the top Bitcoin wallet” by the end of 2024.

Geoff Kendrick, global head of digital assets research at Standard Chartered — a cross-border bank — also believes Bitcoin could reach the $200,000 mark by the end of 2025, regardless of who won the 2024 US presidential election.

Standard Chartered has maintained the $200,000 price level since January 2024, back before ETFs were approved. The anticipation of a wave of institutional investors seems to be the driving factor for their prediction.

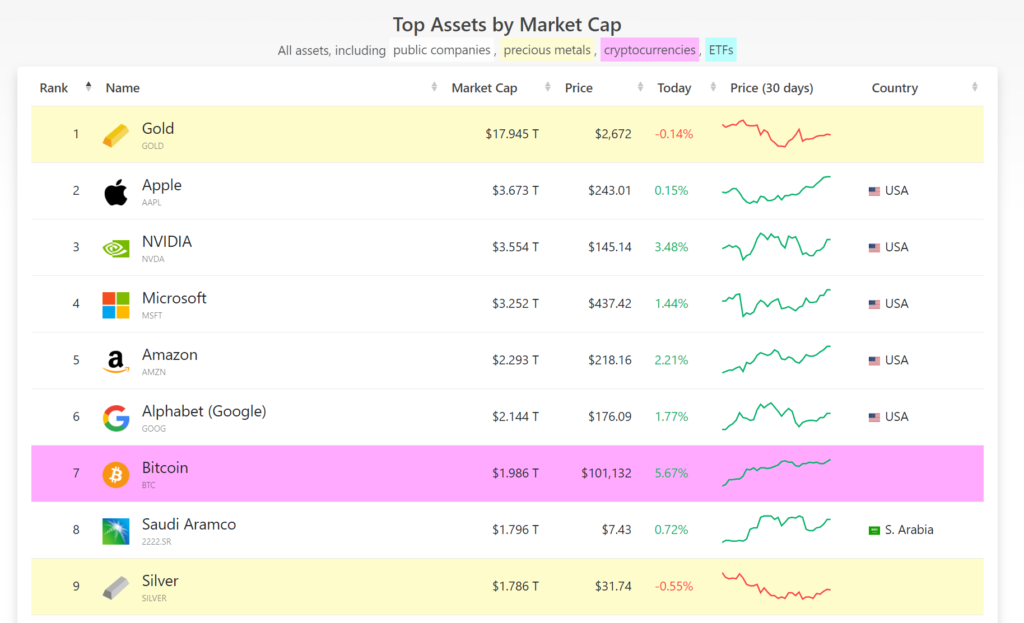

Regardless of where Bitcoin’s price ultimately lands, one thing is clear: It has reached yet another milestone, solidifying its place among the world’s most valuable hard assets. It has already surpassed silver, and now it has its sights set on gold.

Original source: https://cointelegraph.com/news/bitcoin-hits-100k-btc-price-hit-a-new-all-time-high